Content

If you found a qualified delivery otherwise use shipping, you https://happy-gambler.com/online-deutschland-casino/ possibly can make one or more efforts in order to a qualified old age package inside 3-year months birth on the day after the day the fresh delivery are obtained. An experienced birth or use distribution try one distribution out of an applicable eligible later years plan if produced within the 1-12 months months delivery to the go out on which your son or daughter are produced or even the date about what the new legal use of the son is closed. Certified order can cost you are the after the things. Tutors otherwise teachers tutoring otherwise bringing informative kinds outside the family must not be regarding the newest college student and you may meet the after the standards. The fresh area perhaps not subject to the newest tax could be extent this isn’t more the fresh certified degree expenditures (discussed second) to your season to own training equipped from the an eligible informative business (laid out lower than).

Circa Survivor tournament update: Day 13

A professional birth otherwise adoption shipping cannot meet or exceed $5,one hundred thousand for every taxpayer. A distribution you will get try an experienced reservist shipping should your pursuing the requirements try met. Fundamentally, you are a first-go out homebuyer if you had no introduce need for a central family inside the 2-year period stop for the time from acquisition of your house that your shipping is used to purchase, generate, otherwise reconstruct. Particular transmits and rollovers away from property of accredited agreements or annuity agreements by using the significantly equal occasional percentage means commonly sensed a general change in the fresh delivery approach if the what’s needed try met.

IRA Beneficiaries

Included in the Day ten NFL forecasts, here are my personal finest survivor picks this week. There is a chance to use organizations within the survivor pools one to you may not usually consider, as the a single-winnings people is often a gaming favorite. Knowing just while you are complete retirement age is essential whenever declaring your own survivor’s advantages.

Perhaps one of the most enjoyable areas of Survivor weekly are the challenges and tasks contestants must done a week. Because of this, the brand new payout odds of these wagers were below the chances to your downright champion. Selecting a player to get at the final three are easier than picking the new downright champ.

$25k Professional-Sporting events Find’em

An immediate shipment from $4,000 to each and every kid was handled because the $step 1,100000 from typical benefits, $2,five-hundred away from sales efforts, and $500 from earnings. Whenever she founded it Roth IRA (their earliest) inside the 2021, she called each one of the girl five college students since the equivalent beneficiaries. He has not removed any early shipment out of their Roth IRA prior to 2025.

A lot of Accumulations (Shortage of Withdrawals)

Visit SportsLine today to see which team carries you to definitely earn inside the Day 7, all the on the advanced pc model one fingernails survivor selections and you will are upwards above $7,100 while the their first. As an alternative, the fresh design is with certainty backing a group of numerous haven’t made use of inside survivor pools to win outright within the more than 80% of simulations. Before finalizing people Week 7 NFL survivor selections, find which group the newest purple-hot SportsLine Projection Model only ran the-within the on the.

The newest England features obtained around three straight the very first time as the 2022. Month 7 is a little trickier in just two organizations best by the at the least an excellent touchdown. The message on this page will bring standard individual guidance.

SportsLine’s complex computers design simply locked in its finest Day 7 NFL survivor selections

You are many years 62 at the nearest birthday celebration to your annuity carrying out day. The brand new taxable part of your own annuity are $22,080 ($twenty-four,100 – $step 1,920). The brand new income tax-free section of your overall annuity is $1,920 ($1,896, $24). To own figuring the fresh taxable element of their annuity, your made a decision to build independent calculations for your pre-July 1986 money from the package away from $41,three hundred, as well as your own article-June 1986 money on the offer from $700.

- In case your contest finishes and no survivors, the brand new participants that have real time entries going to your finally week away from the new event often separated the brand new $5,one hundred thousand honor.

- Palau try heavily determined by foreign aid — bookkeeping to possess twelve% of its GDP — and possess have gained support of Taiwan and The japanese, and that managed Palau after the Industry Combat I when extremely German-colonized Pacific isles have been regrouped as the a good United nations trusteeship.

- A letter governing is a composed statement given so you can a great taxpayer because of the Irs one to interprets and is applicable the fresh income tax laws otherwise people nontax laws and regulations appropriate to your taxpayer’s particular number of items.

- Indeed, that’s what the lead expert Jason Lisk did this past year, turning $2 for the over $step 3,100000 by taking a “portfolio means” in the the lowest-limits Splash Sporting events tournament.

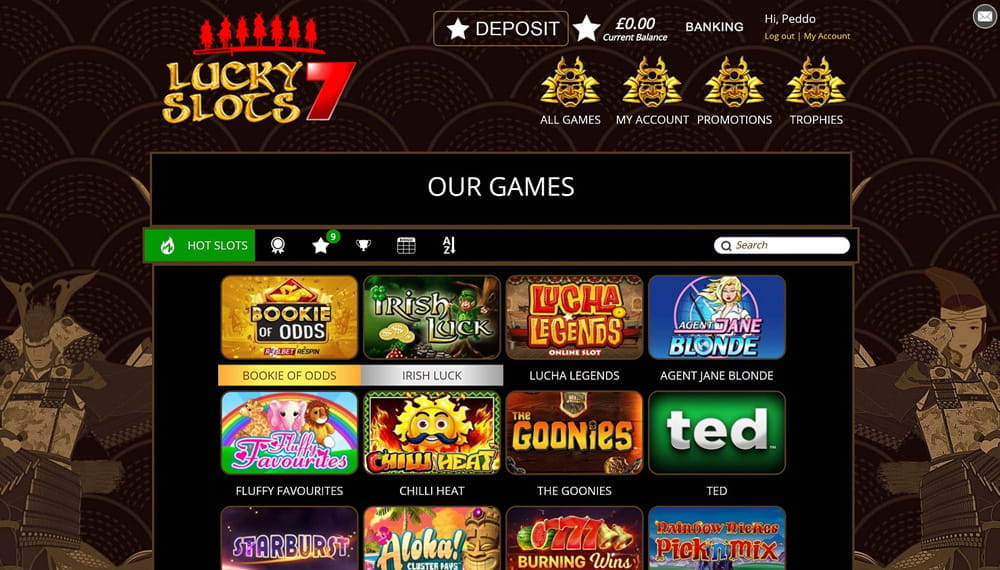

- I view such things as just how easy it’s to make a deposit, how quickly the money places within our membership, extra service charge, and anything we feel you should know.

- Your own beneficiaries should begin delivering withdrawals underneath the standard legislation to have a manager just who passed away ahead of the expected beginning time.

Should your annuity is actually for life, you dictate the full amount of costs by using a parallel in the compatible actuarial dining table. If the annuity is for one particular period, you dictate the total amount of costs by the multiplying the quantity from money becoming produced yearly by amount of ages you are going to found payments. The increase of $228 ($step one,992 − $step one,764 (12 × $147)) is fully taxable. Later, on account of an installment-of-life improve, the annuity fee are risen to $166 per month, otherwise $step one,992 a-year (12 × $166).

- 1. Ride Details

- 2. See Prices

- 3. Confirm